Berner Industrier: A Hidden Nordic Compounder Ready to Run

With a clean balance sheet, a proven M&A playbook, and a CEO from one of Sweden’s top-performing industrial groups, Berner Industrier is set to unlock massive upside.

An Overlooked Industrial Gem Ready to Scale

In the world of Nordic industrial companies, Berner Industrier remains largely under the radar. Founded in 1897, this Swedish-based industrial group specializes in sustainable technology for niche markets yet operates with a modest market capitalization of just $78.5 million.

Despite its long history, Berner is in the early stages of what could be a transformational phase, combining strong cash flows, a disciplined M&A strategy, and a leadership team with a proven track record of value creation.

The company operates through two core business areas and eight subsidiaries across the Nordics:

Technology & Distribution

This segment provides expert consulting and value-added distribution of industrial solutions, including:

Water treatment systems

Vibration dampening solutions

Packaging and process technology

Technical plastics

Its subsidiaries include Christian Berner, which operates in Sweden, Denmark, Norway, and Finland, along with Empakk AS in Norway.

Energy & Environment

This division focuses on pumps and proprietary energy solutions for industrial and process industries, offering:

Zeta boilers, which replace fossil fuel boilers

High-pressure and industrial pumps

Soundproof control rooms

Swedamper dampers, which reduce energy usage and can be integrated into carbon capture solutions

The companies within this segment—Zander & Ingeström, Swedenborg, and Buller Bekämparen—are all based in Sweden.

M&A Is Back on the Table

For years, Berner Industrier lacked the financial flexibility to execute major acquisitions. Until 2017, it focused on smaller, agent-based businesses, which were integrated into Christian Berner’s Nordic operations. But after moving to the main market in 2017, Berner strengthened its financial position and executed four stand-alone acquisitions.

Now, the company has a clear cash flow engine, and M&A is back in focus. The pipeline consists of more than 100 potential targets, ranging in size, with two primary strategies:

Expanding into new niche products

Tuck-in acquisitions to strengthen existing product categories

A perfect example of a successful tuck-in was when Christian Berner acquired Buller Bekämparen, bringing vibration-dampening material production in-house. This move eliminated distributor disintermediation risk and improved margins. Expect more of these strategic acquisitions going forward.

Unlike in previous years, Berner now can self-fund acquisitions and is likely to use debt strategically. CEO Caroline Reuterskiöld has mentioned that Berner has "very little debt" today, which suggests she will likely use leverage to finance an acquisition. A reasonable target would be 2x net debt/EBITA, but she is expected to pay it down post-acquisition, maintaining financial flexibility.

A Leadership Reset With a Proven Playbook

In 2022, Berner appointed Caroline Reuterskiöld as CEO. Previously, she led Lagercrantz’s Niche Products division, which became one of the company’s best-performing segments. During her tenure at Lagercrantz, she executed 5–10 acquisitions, and only one failed to meet expectations, according to Lagercrantz CEO Jörgen Wigh. This suggests she is highly adept at selecting and integrating acquisitions—a critical skill as Berner shifts toward an M&A-driven growth strategy.

Since taking over, Reuterskiöld has:

Strengthened governance

Decentralized key functions such as Finance, IT, and Marketing

Added new board members

Bolstered the balance sheet

This mirrors the Lagercrantz transformation, where strategic M&A and decentralization led to significant shareholder returns.

A Strong Ownership Base Signals Long-Term Commitment

Berner remains a family-controlled business, with Joachim Berner (on the board since 1989) overseeing the company through Gårdaverken AB.

Other notable investors backing this transformation include:

Concejo AB (5.1% voting rights)

Sun Mountain Fund, managed by Christian Solberg & Will Thorndike, the author of The Outsiders

The presence of long-term, strategic investors signals confidence in Berner’s future trajectory.

Why Now? The Restructuring Overhang is Gone

For the past few years, Berner’s EBITA has been weighed down by restructuring costs, including ERP implementation, layoffs, and decentralization. This situation is reminiscent of Bergman & Beving in 2021, which saw a strong margin recovery after completing a similar restructuring.

Order intake is already rebounding. After four weak quarters, Q4 orders surged +29% year-over-year, compared to flat estimates. Sales were 8% higher than expected, with stronger-than-expected EBITA margins of 7.4% in the Energy & Environment segment.

Key Risks to Watch

While Berner Industrier presents an attractive investment opportunity, there are risks investors should consider:

Exposure to the residential construction sector through its Technology & Distribution segment

Historical operating margin volatility, with margins as low as 0.12% in 2012

Acquisition integration risks, which could impact execution

Caroline Reuterskiöld currently holds 62,800 class B shares and 80,000 B warrants. While her stake is not significant, this was also the case for Jörgen Wigh when he became CEO of Lagercrantz. The key indicator will be how she manages and exercises her warrants moving forward.

A Balance Sheet Built for Growth

Berner’s financial position provides ample room for M&A and expansion:

Net Debt/EBITDA = 0.4x (2024), excluding IFRS 16

Cash flow has increased 369% since 2021

Ability to leverage up to 2x EBITDA for acquisitions

Reuterskiöld has indicated that she is willing to take on leverage to execute the company’s growth strategy, but she is expected to pay it down post-acquisition, maintaining balance sheet flexibility.

Valuation: A Potential Multi-Bagger?

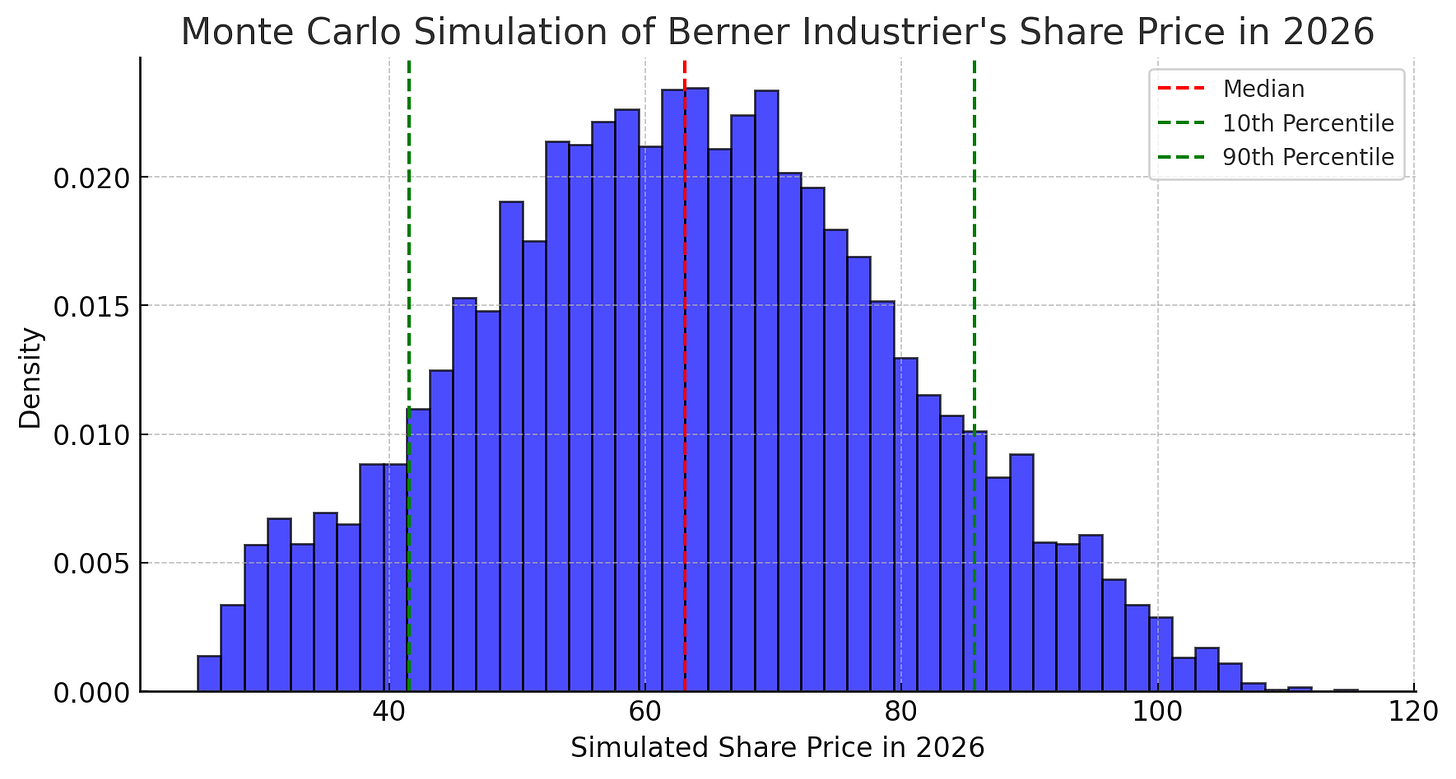

If EBIT grows to 78 by 2026 and the EV/EBIT multiple remains within its historical range of 8.2 to 26.7, a Monte Carlo simulation suggests:

A high probability that the share price will land between 41.56 SEK and 85.68 SEK, with a median estimate of 63.07 SEK

If Berner re-rates to peer multiples:

Bergman & Beving’s EV/EBIT of 27 → 98 SEK per share

Lagercrantz’s EV/EBIT of 35 → 127 SEK per share

At current levels of 41.80 SEK per share, Berner is trading at a significant discount to its potential future valuation.

The Bottom Line

Berner Industrier is at an inflection point. With restructuring completed, a clear M&A pipeline, and a proven leader at the helm, the company is well-positioned to accelerate earnings growth over the next few years.

As it transitions toward a higher-margin, product-focused model, Berner could follow the Lagercrantz and Bergman & Beving playbook—creating substantial shareholder value along the way.

For investors looking for an under-the-radar industrial compounder, Berner Industrier is a name worth watching.

Purchased on December 27, 2024, at 33.7 SEK per share. Please note, this is not investment advice.

Further Reading

Commissioned research: https://cr.abgsc.com/foretag/berner-industrier/start

Presentation at RedEye Serial Acquirer event:

Berner Industrier: CEO Caroline Reuterskiöld presents at Redeye Serial Acquirers Conference 2025