Aptitude Software: A High-Margin SaaS Transformation Opportunity

Building on past success at Bravura and Trubridge, Pinetree Capital and L6 Holdings set their sights on the next big opportunity: Aptitude Software Group

Investment Thesis

Aptitude Software is undergoing a strategic transformation from a service-heavy business to a high-margin SaaS-led model, focusing on Fynapse, its AI-powered finance data management platform. This shift is designed to drive scalability, profitability, and long-term revenue quality, positioning Aptitude for sustainable growth in the evolving finance digitization sector.

Company Overview

Originally a subsidiary of Microgen Financial Systems, Aptitude became independent in 2014 and has since expanded through key acquisitions, including RevStream (2017) and MPP Global (2021). The company divested Microgen in 2020 to concentrate on its core financial software business and launched Fynapse in 2022, a next-generation finance data platform integrated with Microsoft Dynamics 365.

Leadership Team

CEO: Alex Curran – Started 2004 in Marketing & Sales, Curran has been instrumental in leading Aptitude’s transition to a SaaS-led model.

Management Bonus Scheme: Executive Directors can earn up to 125% of salary based on financial and strategic performance measures, with 20% of bonuses subject to a two-year deferral in shares.

PSP Awards: Long-term incentive plans (LTIPs) are based on TSR and financial performance, aligning leadership rewards with shareholder value creation.

Non-Executive Chairman: Ivan Martin will step down from the Board in Q2 2026.

Strategic Shift: SaaS-Led Growth

Aptitude is pivoting towards a partner-driven, SaaS-first model to enhance scalability and profitability. The focus is on three core solutions:

Finance Transformation: Fynapse, Aptitude Accounting Hub, and RevStream.

Compliance: IFRS 17 and Lease Accounting solutions.

Subscription Management: eSuite.

The company de-emphasizes services to accelerate Fynapse adoption, recognizing that a services-heavy approach limits scalability. CEO Alex Curran stated,

“We recognized that a services-heavy approach would constrain scalability, slow Fynapse adoption, and limit long-term revenue growth. In 2025, we are accelerating the shift further, making necessary adjustments to fully embed this model.”

Industry Landscape and Market Potential

The finance digitization sector is experiencing strong demand for automation, regulatory compliance, and AI-powered finance solutions. Aptitude is well-positioned to capitalize on these trends, leveraging its expertise in finance automation and strategic partnerships with Microsoft, Deloitte, EY, KPMG, Capgemini, and HSO.

Key Financial Risks

High Operating Expenses: Aptitude’s ARR growth slowed to 2% in 2024 from 15% in 2023, mirroring challenges faced by Bravura Solutions, a position held by Pinetree Capital, which reported a substantial net loss due to rising costs and declining revenue.

Cash Flow and Debt Management: Trade receivables increased, with £6.8 million overdue at year-end. The company’s ability to maintain liquidity and optimize working capital is critical.

Capital Allocation Concerns: R&D costs accounted for 25% of revenue in 2024, a slight increase from last year, with plans to reduce this proportion over time.

Leadership Execution: CEO Alex Curran’s background in sales and marketing presents execution risk, particularly in capital allocation.

One area that does not pose a significant risk is acquisitions, as the company’s capital allocation strategy prioritizes organic growth over inorganic expansion. Additionally, it is reassuring that Aptitude is engaging in scenario planning, as outlined in the 2024 annual plan.

Ownership and Shareholder Strategy

Mission Trail Capital: Led by Joshua Braden, owns over 10%, since 29-Jan-2025.

Pinetree Capital: Holds 2%. Aptitude has been held by Pinetree Capital since 2023.

L6 Holding: Recently increased its stake to 5.4%, indicating confidence in Aptitude’s turnaround potential.

Why now?

Market frothiness and forced selling

Recent market frothiness and forced selling, including FIL Limited's share offload, have created a temporary dislocation in Aptitude Software Group’s stock. While 2024 revenues fell short of expectations, the company remains highly profitable and is transitioning to a high-margin, partner-driven ARR model—expected to drive long-term growth.

Strong Growth & Execution

Fynapse saw a 15x increase in active pipeline opportunities and 10x growth in value since mid-2023, while enterprise deals with T-Mobile, HCSC, KPMG, and Chubb reinforced market traction. Software churn improved to 8% (from 10% in 2023) with 21 client expansions, and a partner-led sales strategy is strengthening go-to-market execution.

Pinetree Capital and L6 Holding are upping their stake significantly

Pinetree Capital, a known value-oriented investor, often targets enterprise software businesses undergoing strategic transitions. Their stake in Aptitude aligns with their focus on underappreciated software companies with high-margin potential. Their approach typically involves:

Encouraging operational efficiency and disciplined capital allocation.

Advocating for shareholder-friendly policies, such as buybacks.

Supporting leadership teams that drive long-term ARR growth.

Pinetree’s involvement, albeit a small stake, signals confidence in Aptitude’s ability to execute its transformation successfully.

Valuation and Growth Potential

Aptitude currently trades at £2.77, with an EV/S ratio of 1.91, and sales of £70.04 million. Assuming in 2026, the sales could be between £70.00 million and £75.65 million and the EV/S ratio between 1.58 and 3.34, with a mean of 1.91. Bravura currently trades at an EV/S of 3.34, which is near Aptitude's 10-year mean.

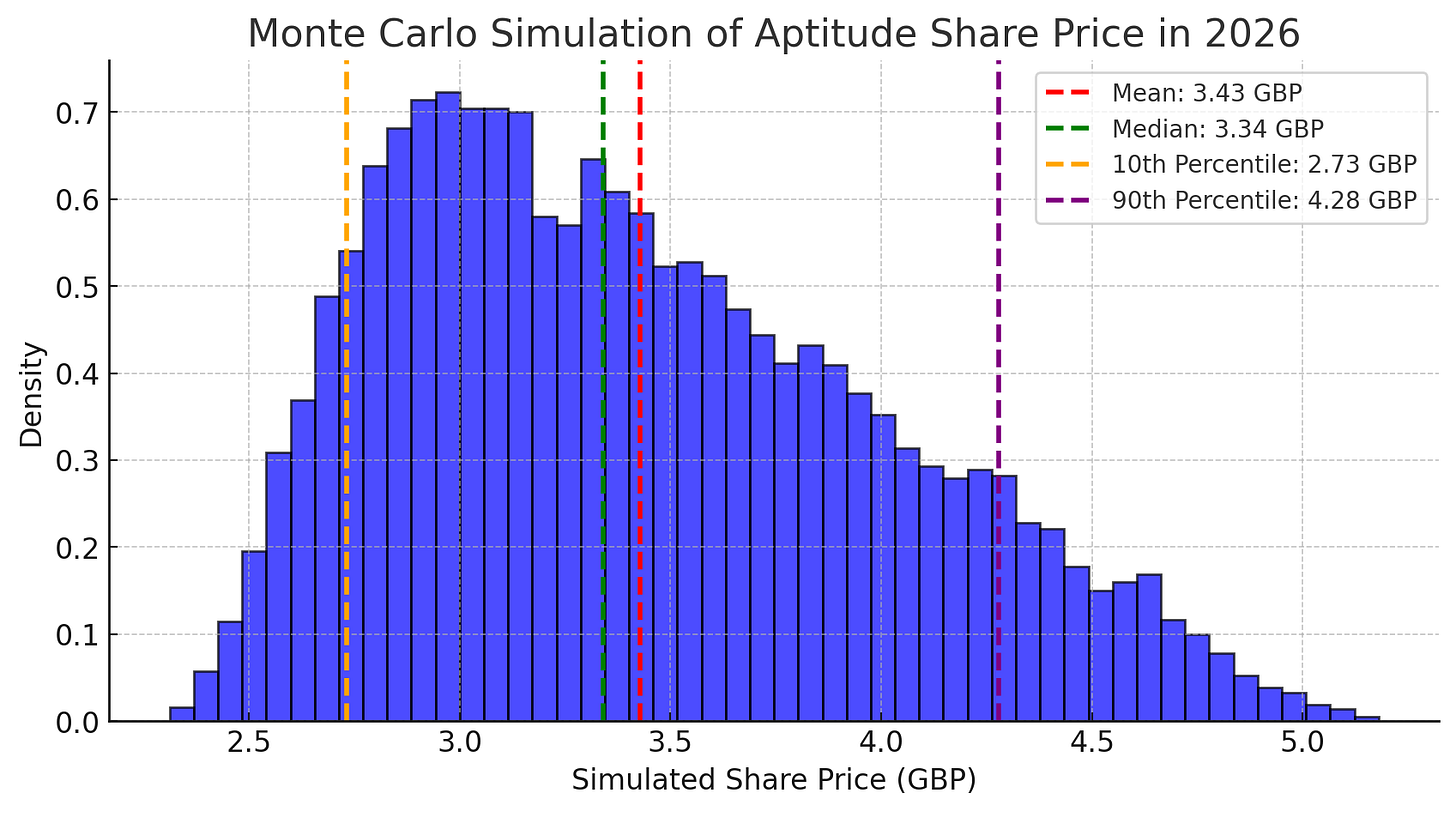

Using a Monte Carlo simulation suggests the following potential share prices for Aptitude in 2026:

Mean share price: £3.43

Median share price: £3.34

10th percentile: £2.73 (lower bound estimate)

90th percentile: £4.28 (upper bound estimate)

The estimated Compound Annual Growth Rate (CAGR) for a 2-year investment period in Aptitude is:

Mean CAGR: 11.25%

Median CAGR: 9.81%

10th percentile CAGR: -0.70% (worst-case scenario)

90th percentile CAGR: 24.28% (best-case scenario)

This means there's a high probability that the share price will fall within £2.73 – £4.28, with an expected (mean) value around £3.43 (11.2% CAGR). Given Pinetree Capital's and L6's past investments in Bravura and Trubridge, it wouldn't be surprising if this investment leaned towards the higher end of the simulated share price shown below.

Final Thoughts: A Compelling but Execution-Dependent Opportunity

In the best-case scenario, this investment could deliver a 90th percentile CAGR of 24.28%, with the share price likely falling between £2.73 – £4.28, and an expected value around £3.43 (11.2% CAGR). Given Pinetree Capital's and L6's past investments in Bravura and Trubridge, the outcome could skew toward the higher end.

With major shareholders increasing their stakes and a clear path to higher-margin SaaS revenue, Aptitude Software presents an attractive opportunity. Pinetree’s involvement signals confidence in the company’s transformation, aligning with its strategy of backing underappreciated software businesses with high-margin potential.

However, it's crucial for Damien Leonard to join the Board, or for a trusted close advisor to step in, along with the appointment of a skilled CFO to steer the company's growth and ensure effective capital allocation. Other risks remain, including short-term revenue impact, high operating expenses, and cash flow challenges. These need to be weighed against the potential upside.

As of this writing, the author has held shares in Pinetree Capital ($PNP.TO) since 2021. The information provided is not investment advice.

I like the company but your thesis is effectively ‘pine tree buying more’ as if they could brute force multiple expansion. You say execution dependent but the thesis is clearly just a rerating play.

Sorry but I think this is much more speculation, than it is investment